In previous posts, we discussed the importance of correctly capturing Requirements (capitalized to indicate compliance requirements). In conversations with large investment/asset managers (>$100bAUM) they have invested significant budgets in the on-boarding process. That process generally includes everything from KYC and AML to IMA/source documentation reviews.

In spite of that formality, the process of tracking updates is often fragmented. Once a client is on-boarded, updates and changes have different points of origin, and so may have different points of entry. It may be left up to Compliance to ensure that they have copies of all changes and that they compare any updates to the current requirements.

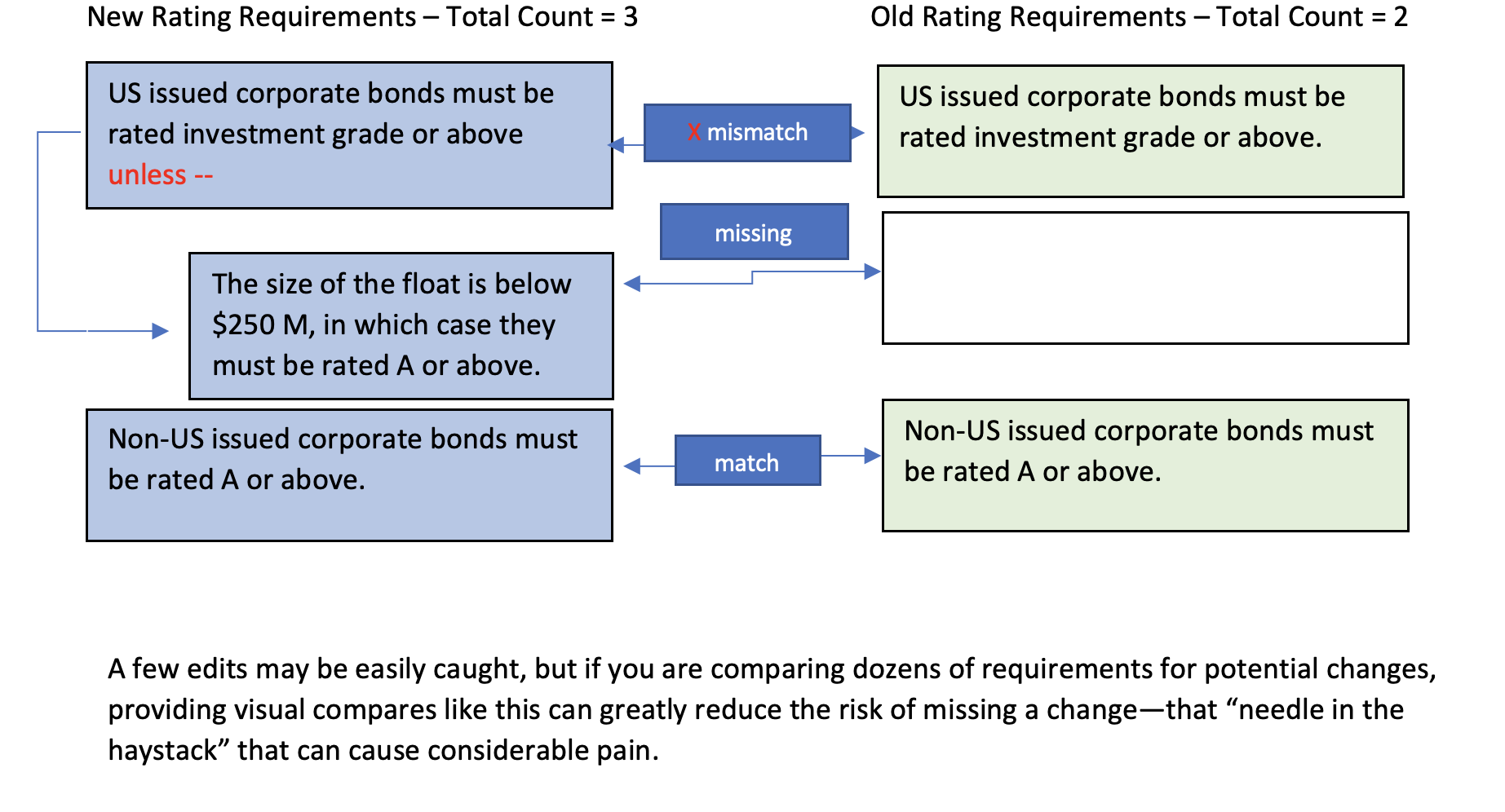

As an example, I recently compared an email that had been sent to a client’s relationship manager. In the email, the client added a nuance to the acceptable ratings for a bond, based on the size of the float (amount issued) of that instrument. In this case, the client decided they wanted a higher rating if the issuance was smaller and indicated that the attached Exhibit A of the IMA was updated accordingly. It was not. Whether the relationship manager sent the wrong Exhibit A or the client neglected to update it, it would have been very easy to miss, particularly with all of the other updates.

To more easily catch changes, IMP suggests comparing requirements (versus documents) and filtering on key criteria, such as ratings, in a Kanban-style form: